News

The dreaded tax return: this could be heaven or this could be hell

This article is more than 7 years old.

From next Monday, half the country will be furiously logging on at skat.dk to discover whether they’ve got a green or red figure next to their name

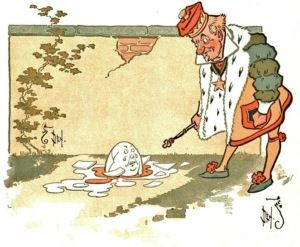

For some, it will be Easter eggs all round, for others, it will feel like swapping places with Humpty Dumpty (photo: WW Denslow)

It’s a little like a medical – it could go either way: “You’ve got the heart of a 25-year-old, sir / Are you sure you’re only 42?”

Every year the Danish residents learn where they stand with their taxes and in the immortal words of ‘Hotel California’, “this could be heaven or this could be hell”.

Like Humpty Dumpty

For the majority of taxpayers, around 75 percent, it is good news. Over the course of last year, they paid too much in tax and they’re now due a rebate – sometimes it can feel like an early Easter present.

The remaining 25 percent, though, will feel like Humpty Dumpty at the bottom of the wall as they’re faced with a bill. In some cases, it could be sizeable.

Please be green ….

From next Monday, an estimated 3.5 million of the country’s 4.6 million taxpayers will start visiting Skat.dk to find out their standing, which is based on information obtained from banks, employers, pension companies and the taxpayers themselves via their preliminary tax assessments.

The red or green number can be found in the ‘TastSelv’ section of the website.

Difficulties logging on

But be warned: it can get pretty hectic trying to find out, and the website has been known to buckle due to the demand. Last year, there were 2.5 million log-ins over the first two days, resulting in long queues to get on.

READ MORE: Massive online queue as annual tax returns are released

Additionally, it can be tricky getting through to SKAT via telephone. Every year it assigns 550 employees to dealing with an expected 80,000 enquiries.

It is also via TastSelv that you have a chance to correct your tax information (providing it is done by the end of March) – 15 percent tend to do so every year, although in one out of 50 cases, a submission in writing is normally necessary.